Introduction

Starting from 22 November 2020, all FIN users classified as Supervised Financial Institutions (SUPE) and Payment System Participants (PSPA) must provide a status confirmation for the outcome of payments received. The eligible messages are MT 103, MT 103 STP, MT 103 REMIT, or ISO PACS.008.

A confirmation can be considered as an acknowledgment of an event. For example, when you receive a confirmation email after booking a flight, it serves as an acknowledgment that your booking has been successfully processed. Similarly, confirmation of payment is required by the SWIFT network upon processing the transaction in the FIN network. There are 3 possible statuses while processing the universal confirmations

- ACCEPT

This status means that the beneficiary bank has confirmed to the Swift network that the ultimate beneficiary’s bank account has been credited with the payment.

- REJECT

This status means that the payment has failed on its way to the beneficiary. This can be for several reasons

- IN PROGRESS

This status shows that the payment has been instructed by the paying bank but the beneficiary bank has not yet confirmed that the beneficiary has been credited

Universal Confirmation Timeline

Below Given Diagram will show the Allowed timeline for a SWIFT universal confirmation

From the above diagram, Scenario 1 shows that the MT103 transaction is initiated on its value date. Assuming that the transaction will be received by the beneficiary bank on the value date (VD), the bank has 2 business days to send the confirmation back to the SWIFT tracker.

Allowed date to send confirmation = Transaction Value Date + 2 (Business Days)

In Scenario 2, the transaction is initiated a day before the value date, indicating that this is a future-date transaction. Assuming that the transaction is received by the beneficiary bank on VD-1, the bank gets 3 business days to send the confirmation back to the SWIFT tracker.

If the transaction is pending and requires more than 2 business days to process, the bank should send a PENDING confirmation to the SWIFT tracker.

Banks can send confirmation even after 2 days or skip it completely. However, this will be analyzed by the SWIFT tracker, as banks are scored based on their adherence to this policy. This score will be visible to all the SWIFT members via the basic tracker utility. The banks will be given GREEN, ORANGE and RED statuses

Ways to send a Confirmation to SWIFT tracker

There are multiple ways on how a confirmation can be sent to the tracker. Bank can choose the option which is comfortable to them. The confirmation to the tracker can be sent to the tracker BIC which is TRCKCHZZVAL

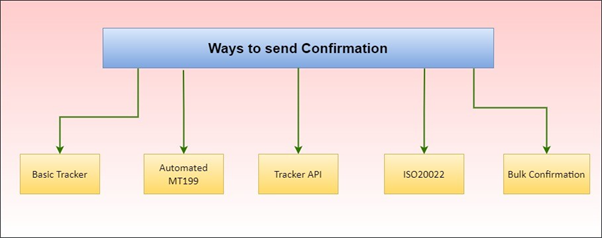

Ways to send a Universal Confirmation

There are 5 ways to send a confirmation to SWIFT Tracker

- Basic Tracker

- Automated MT199

- Tracker API

- ISO20022

- Bulk Confirmation

Basic Tracker

The basic tracker is available to all the GPI participants, using this tool banks can check the confirmation status of the processed transactions. The basic tracker can be used by the banks to manually update the status of the transaction

Automated MT199

Banks can set an automatic generation of an MT199 upon the transaction processing completion. The standard MT199 format can be used to generate the confirmation back to the SWIFT tracker.

Tracker API

The Swift tracker exposes an API which can be used by the banks to update the tracker.

ISO20022

Using the ISO20022 message the tracker can be updated

Bulk Confirmation

Bulk Confirmation can be sent to the tracker using the CSV format allowed by SWIFT. The banks can wait for the day to end and send an accumulated CSV file to the tracker

Universal Confirmation Scenarios

Below are the scenarios for sending the SWIFT universal confirmation:

Mandatory Confirmations

- Mandatory ACCEPT Confirmation

Mandatory Accept confirmation sent by the Beneficiary bank to Tracker

- Mandatory ACCEPT Confirmation – Intermediary Involved

Mandatory Accept confirmation sent by the Beneficiary bank to Tracker

- Mandatory REJECT Confirmation

Mandatory Reject confirmation sent by the Beneficiary bank to Tracker

- Mandatory REJECT confirmation – Intermediary Involved

Mandatory Reject confirmation sent by the Beneficiary bank to Tracker

- Mandatory REJECT confirmation – Intermediary Involved – Transaction Rejected by Intermediary

Mandatory Reject confirmation sent by the Intermediary bank to Tracker

RECOMMENDED CONFIRMATIONS

- Recommended PENDING Confirmation

Recommended Pending confirmation sent by the Beneficiary bank to Tracker

- Recommended PENDING Confirmation – Intermediary Involved

Recommended Pending confirmation sent by the Beneficiary bank to Tracker

- Recommended PENDING Confirmation – Intermediary Involved – Intermediary HOLD the transaction

Recommended Pending confirmation sent by the Intermediary bank to Tracker

- Recommended PENDING Confirmation – Intermediary Involved – Transaction Transferred Outside FIN Network

Recommended Pending confirmation sent by the Beneficiary bank to Tracker