What is NPA ?

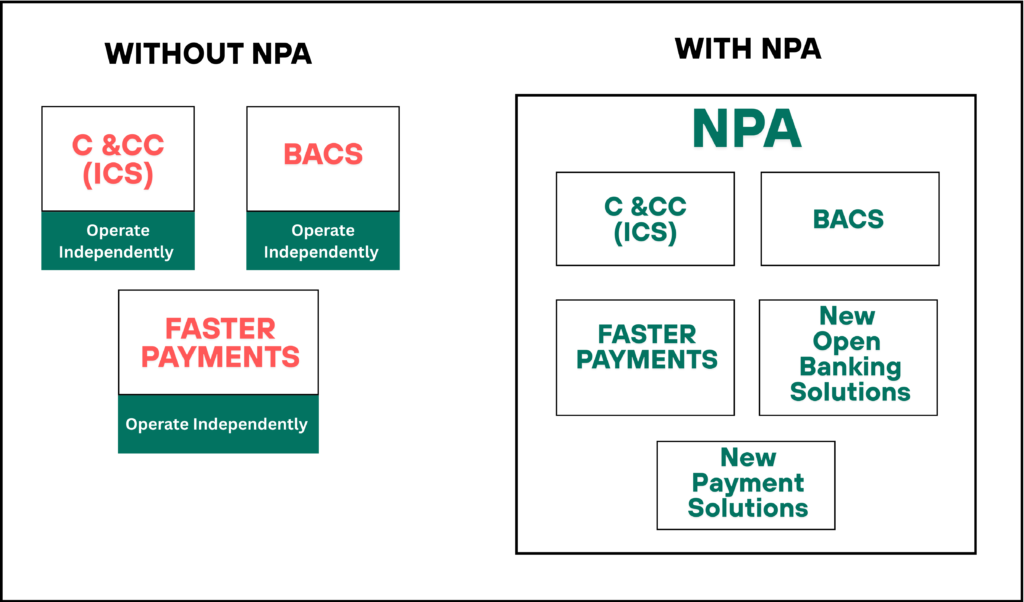

The New Payment Architecture (NPA) is a modern payment infrastructure developed by Pay.UK to accommodate existing payment schemes such as Bacs, Faster Payments, and C&CC on an updated platform while also providing a foundation for new payment innovations, including open banking.

The New Payment Architecture (NPA) will mark a revolutionary step in the UK’s payments landscape when it launches at the end of 2025.

Currently, systems operated by Pay.UK like Bacs, C&CC (Image Clearing System for cheque processing), and Faster Payments function independently with their own infrastructure. Under the NPA, these systems will be consolidated into a unified framework.

The NPA represents a modernized infrastructure designed to support multiple payment schemes, including the existing ones and it also creates opportunities for new innovations in the payments domain, allowing them to integrate into the NPA framework easily.

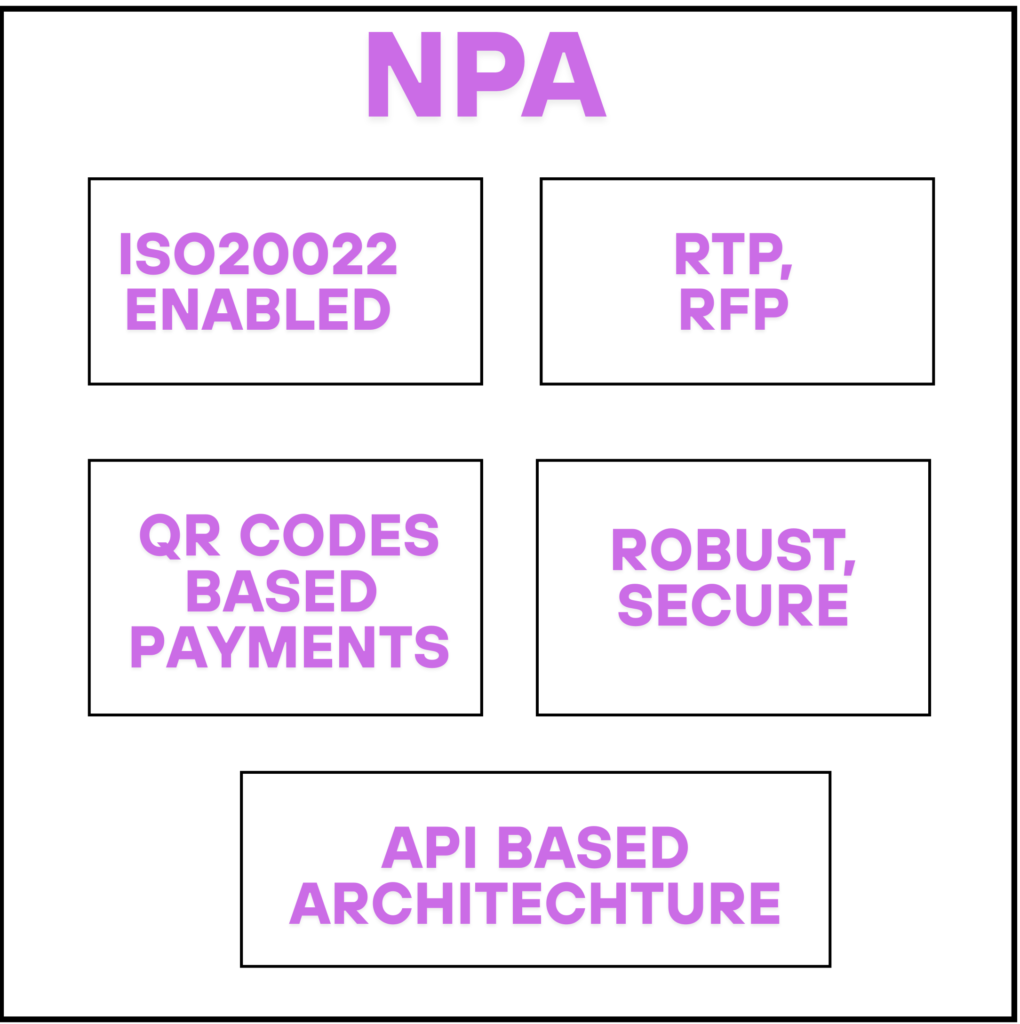

The NPA will operate entirely on ISO 20022 payment messaging standards. This standardized approach makes this framework adaptable and futureproof. Its an API-driven architecture , which makes payment processing fast and makes room for open banking innovations

The primary goal of the NPA is to upgrade the UK’s payment infrastructure with new technologies , incorporating AI and ML along with the complete API enabled architecture secure payments

How the concept of NPA Initiated ?

The New Payment Architecture (NPA) took shape in 2015 when the Payment Systems Regulator (PSR) initiated the cross-industry Payments Strategy Forum to encourage collaboration and innovation in payments. One of the forum’s key recommendations was to consolidate the operations of Bacs, Cheque and Credit Clearing (C&CC), and Faster Payments, alongside introducing the concept of the NPA. In 2016, the Payment System Operator Delivery Group (PSODG) was established in partnership with the Bank of England to address the consolidation process. By 2017, the PSODG recommended the creation of a New Payment System Operator (NPSO). In 2018, the NPSO transitioned to Pay.UK. now Pay.Uk is responsible for the development of NPA

What are the Advantages ?

The NPA will be ISO 20022 enabled, which is excellent news as the global payments industry moves toward adopting this universal standard. This will enhance the interoperability and adaptability of the new system. It also supports Real-Time Payments (RTP), Request for Payments (RFP), and QR-based transaction which meets the needs of retail and domestic transfers. Its API-driven architecture allows for easy integration and provides a platform for ongoing innovation.

Along with these new technology support, NPA will continue processing the Bulk Transactions on the new infrastructure

is CHAPS Included ?

No, CHAPS (Clearing House Automated Payment System) is not included in the New Payment Architecture (NPA). CHAPS is a high-value payment system operated by the Bank of England and continues to function independently of NPA. The NPA primarily focuses on consolidating and modernizing retail payment systems such as Bacs, Faster Payments, and Cheque and Credit Clearing (C&CC)

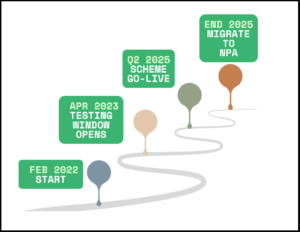

Timeline for NPA