In today’s financial landscape, AI is reshaping how banks operate and engage with customers. By integrating AI into their systems, banks are enhancing efficiency and delivering more personalized and secure services. From providing real-time assistance to improving fraud detection and forecasting, AI is transforming the way financial institutions manage their operations and serve their clients. Here’s a closer look at how AI is making an impact in these areas:

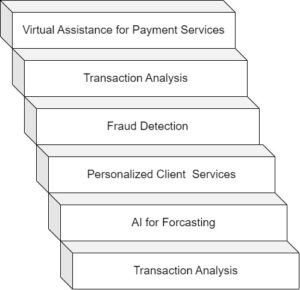

Virtual Assistance for Payment Services

AI-powered virtual assistants are changing the way we interact with payment services. Imagine having access to real-time help, any time of day or night, without waiting on hold or navigating complex phone menus. These smart assistants can quickly answer questions, guide users through payment steps, and solve common issues—all without involving a human agent. Whether it’s a chatbot on your banking app or a voice-activated assistant, these tools are designed to make the payment experience smoother, faster, and more intuitive. They’re always there when needed, making life a little easier for both customers and businesses.

John finishes a set of weights and checks his phone. He sees the message from his mom.

Mom :

“Hey John, don’t forget the electricity bill is due today! You have to pay it urgently!”

John, still catching his breath from his workout, decides to handle it without interrupting his routine.

John (talking to Siri):

“Hey Siri, please initiate a payment for my electricity bill.”

Siri:

“Got it. Which account would you like to use?”

John:

“Use my checking account.”

Siri:

“Okay. What’s the amount?”

John:

“$120.”

Siri:

“Payment of $120 for your electricity bill from your checking account is ready. Should I confirm and send?”

John:

“Yes, please send it.”

Siri:

“The payment has been successfully sent.”

John continues his workout, knowing the bill is paid on time.

Transaction Analysis

In large banks, expert teams traditionally manage the analysis of customer behavior and payment commitments. The integration of AI has significantly improved the process by reducing the margin of error and automating key aspects. AI now provides substantial relief to these experts by efficiently handling the examination of payment messages, identifying and correcting missing fields, and validating transaction formats.

AI and machine learning (ML) enhance transaction analysis by enabling real-time evaluation of transaction volumes, payment patterns, and various data points. This technological advancement supports the prediction of trends, detection of anomalies, and data-driven decision-making. Consequently, operational efficiency is improved, and the accuracy of payment analysis is elevated, benefiting both the banks and their expert teams.

Fraud Detection

AI has revolutionized how we handle payment fraud. By analyzing vast amounts of transactional data, machine learning algorithms can identify anomalies and flag potentially fraudulent activities. These systems continually learn from new data, which sharpens their ability to detect and prevent fraud over time.

Here’s how AI tackles payment fraud:

- Anomaly Detection: Transaction patterns are examined, and anything that deviates from a customer’s usual behavior is flagged for further investigation if it appears suspicious.

- Predictive Analytics: Historical data is analyzed to predict the likelihood of fraud, identifying patterns and trends often associated with fraudulent activities.

- Behavioral Analysis: Customer behavior, including spending habits and transaction locations, is tracked. Sudden changes or unusual patterns are flagged as potential fraud.

- Pattern Recognition: Known fraud patterns and tactics are detected by analyzing large datasets, allowing for the identification of recurring schemes used by fraudsters.

- Real-Time Analysis: Transactions are processed instantly, enabling immediate detection and action on suspicious activities before they can cause significant damage.

- Network Analysis: Connections between entities are explored to reveal hidden relationships or networks involved in fraudulent activities.

- Contextual Analysis: The context of transactions, such as time, location, and device used, is assessed to ensure they align with legitimate behavior.

Personalized Client Services

Strengthening the customer base can be achieved by leveraging AI modules to deliver personalized offers. For banks, it’s crucial to understand customer needs and provide relevant services accordingly. For instance, if a customer frequently searches for car information, offering a car loan—if they meet eligibility criteria—can be a highly effective strategy.

AI enhances personalized services by analyzing user behaviors, preferences, and transaction histories. Payment platforms use this data to offer tailored recommendations, special offers, and customized services based on individual customer profiles. This approach not only increases customer engagement but also boosts overall satisfaction.

Additionally, AI can enhance customer relationships by creating dynamic, context-aware and real time interactions. For example, if a customer makes a purchase while traveling abroad, AI can immediately respond by offering relevant travel-related benefits. This might include providing information on the nearest currency exchange locations or offering travel insurance tailored to their current destination. By addressing the customer’s immediate needs in real-time, the bank demonstrates a high level of attentiveness and support, reinforcing the customer’s trust and strengthening their overall relationship with the bank.

AI for Forecasting

Forecasting cash flows can be challenging for many banks due to market uncertainties and unpredictable business figures. AI-driven platforms, however, offer valuable insights by predicting future trends in payments and cash flow. By analyzing historical data, AI models can provide a more accurate estimate of future volumes, payment behaviors, and potential bottlenecks. This allows banks to plan more effectively and make informed decisions, giving them a clearer picture of what to expect and how to prepare for future financial scenarios.

High level Benefits of AI in Payments

- Enhanced Efficiency: AI speeds up processes like fraud detection, transaction analysis, and customer support, resulting in faster payment flows and lower operational costs.

- Improved Payment Security: AI’s ability to detect and prevent fraud in real-time is invaluable, reducing risks for both payment processors and customers.

- Data-Driven Decisions: AI can sift through vast datasets, providing insights that would be difficult for humans to discover, leading to smarter business decisions.

Limitations of AI in Payments

- Privacy Concerns: AI systems often require access to large volumes of sensitive data, raising privacy and data security issues.

- False Positives and Inaccuracies: AI is not infallible; incorrect predictions or fraud alerts can disrupt legitimate transactions and frustrate users.

- Initial Costs: Implementing AI systems can be expensive due to the infrastructure and expertise required, especially for smaller businesses.